Should you have a personal umbrella policy

Table of Contents

Table of Contents

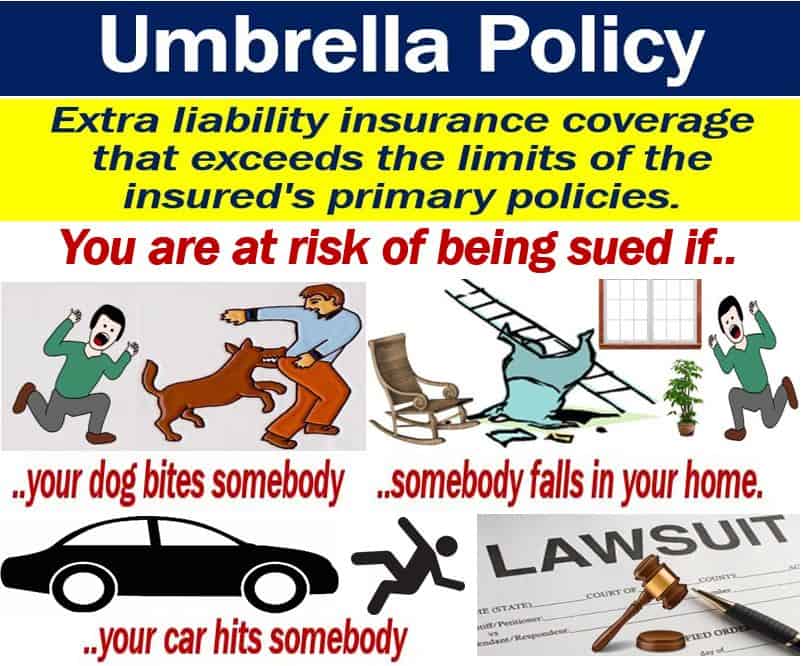

Have you ever wondered if you have enough insurance coverage to protect your assets? Do you feel confident that your current coverage will protect you in case of a catastrophic event? Many people don’t realize that their insurance may not be enough to protect them in case of a lawsuit. That’s where Umbrella Policy Quote comes in, providing an extra layer of protection that can make all the difference.

Pain Points Related to Umbrella Policy Quote

No one wants to think about the possibility of a lawsuit, but the truth is, they can happen to anyone. And if you don’t have enough insurance coverage to protect your assets, your financial future could be in jeopardy. Even if you are a careful and responsible person, accidents can still happen, and if you are found liable, the costs can quickly add up. This is where Umbrella Policy Quote comes in, providing an extra layer of protection that can help you avoid financial ruin.

Answering the Target of Umbrella Policy Quote

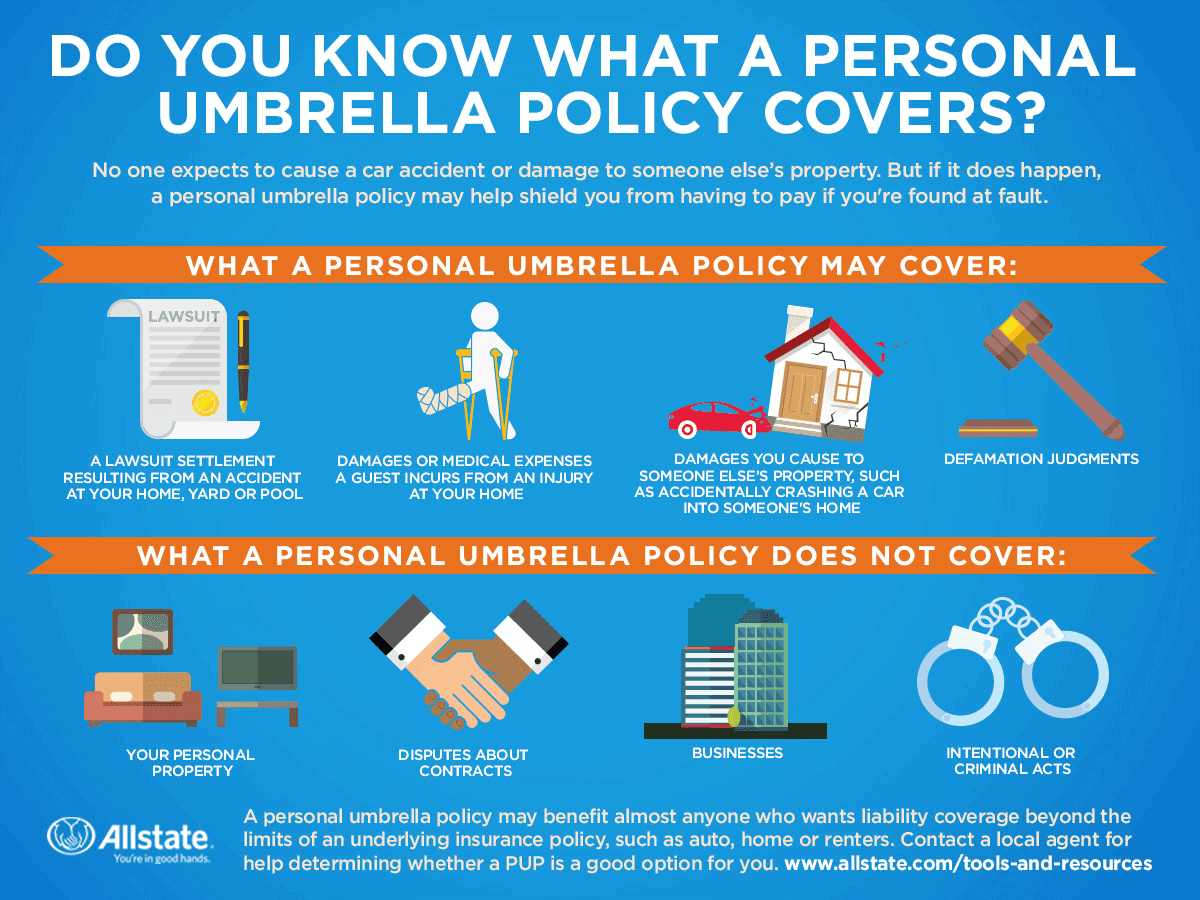

An Umbrella Policy Quote is an additional insurance policy that provides extra liability coverage that goes beyond what your standard insurance policies cover. This policy can help protect your assets, such as your home, car, and savings, in case of a lawsuit. It can also provide coverage for incidents that are not covered by your other policies, such as a dog bite or a swimming pool accident. An Umbrella Policy Quote can be a smart investment for anyone who wants to protect their financial future.

Summary of Main Points Related to Umbrella Policy Quote

In summary, an Umbrella Policy Quote is a type of insurance that can provide an extra layer of protection for your assets in case of a lawsuit or other catastrophic event. This policy can help protect your home, car, and savings, and can provide coverage for incidents that are not covered by your other insurance policies. Getting an Umbrella Policy Quote may be a smart investment for anyone who wants to ensure they are adequately protected.

Who Needs Umbrella Policy Quote?

Anyone who wants to protect their assets and financial future can benefit from an Umbrella Policy Quote. This policy is especially important for those who have significant savings, valuable assets, or a high net worth. It can also provide peace of mind for those who are in high-risk professions, such as doctors or lawyers, or for those who have a higher risk of being sued, such as landlords or business owners. I personally know the importance of Umbrella Policy Quote. My neighbor was sued by a person who accidentally slipped on his property. She claimed that she was severely injured and was seeking millions in damages. My neighbor had homeowners insurance but the policy limit was not enough to cover the damages. Fortunately, he had Umbrella Policy Quote that covered the remaining amount. This incident made me realize the importance of having an Umbrella Policy Quote policy for additional protection.

How to Get Umbrella Policy Quote?

Getting an Umbrella Policy Quote is easy. You can start by contacting your insurance agent to discuss your options. They will be able to advise you on how much coverage you need and what type of policy may be best for you. It’s important to shop around and compare quotes from different insurance companies to ensure you are getting the best deal. Some insurance companies may offer discounts if you bundle your Umbrella Policy Quote with other policies, such as your homeowners or auto insurance.

Benefits of Umbrella Policy Quote

One of the biggest benefits of an Umbrella Policy Quote is the extra layer of protection it provides. This policy can help protect your assets from lawsuits and financial ruin. It can also provide coverage for incidents that may not be covered by your other insurance policies. Furthermore, getting an Umbrella Policy Quote can be a cost-effective way to ensure you are adequately protected, as it often costs less than you may think.

How to Determine Your Umbrella Policy Quote Coverage Amount?

The amount of Umbrella Policy Quote coverage you need depends on several factors, such as your net worth, assets, and risk of being sued. A general rule of thumb is to have coverage that is equal to your net worth. However, it’s always best to speak with your insurance agent to determine the appropriate coverage amount for your specific circumstances.

Question and Answer

Q: Is Umbrella Policy Quote only for wealthy individuals? A: No, anyone can benefit from an Umbrella Policy Quote. It’s especially important for those with significant assets, but it can also provide coverage for incidents that are not typically covered by other insurance policies. Q: Can I bundle my Umbrella Policy Quote with other insurance policies? A: Yes, many insurance companies offer discounts if you bundle your Umbrella Policy Quote with other policies, such as your homeowners or auto insurance. Q: How much does Umbrella Policy Quote cost? A: The cost of Umbrella Policy Quote varies depending on the amount of coverage you need, your risk factors, and the insurance company you choose. However, it’s often more affordable than you may think. Q: Is it worth getting Umbrella Policy Quote? A: Yes, getting Umbrella Policy Quote can provide an extra layer of protection for your assets and financial future. It can also provide peace of mind and may ultimately save you from financial ruin in case of a lawsuit or other catastrophic event.

Conclusion of Umbrella Policy Quote

In conclusion, Umbrella Policy Quote can be a smart investment for anyone who wants to protect their assets and financial future. This policy provides an extra layer of protection that can help prevent financial ruin in case of a lawsuit or other catastrophic event. If you are considering Umbrella Policy Quote, be sure to shop around and compare quotes from different insurance companies to ensure you are getting the best deal.

Gallery

What Is An Umbrella Policy? Definition And Some Examples

Photo Credit by: bing.com / umbrella policy definition liability

#openmind | Umbrella Quotes, Mindfulness, Umbrella

Photo Credit by: bing.com / inspirational

Should You Have A Personal Umbrella Policy?

Photo Credit by: bing.com / mistake income

How Much Is A Million Dollar Umbrella Policy - Dollar Poster

Photo Credit by: bing.com / allstate renters liabilities liability protection malpractice blitz borror

Should You Have A Personal Umbrella Policy? | Blog | Noyes Hall & Allen

Photo Credit by: bing.com / umbrella policy personal infographic insurance need should garnish wages someone noyes allen hall